Form W 8ben 2017

What is the Form W-8BEN

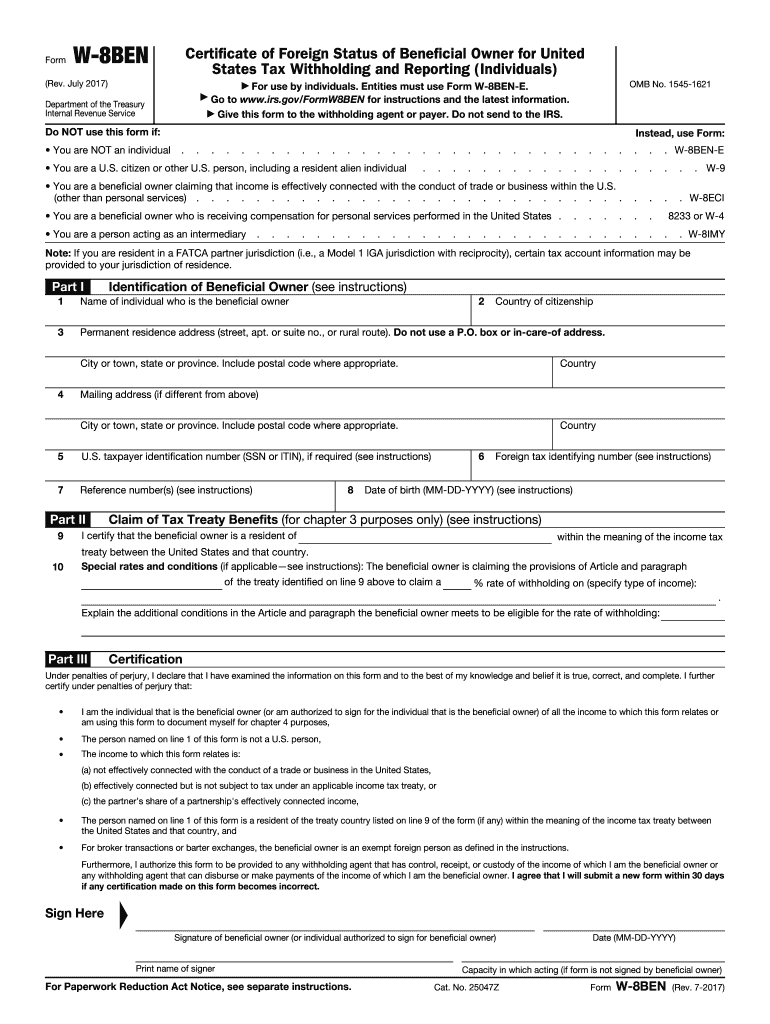

The Form W-8BEN is a tax form used by foreign individuals and entities to certify their foreign status and claim any applicable benefits under an income tax treaty. This form is essential for non-U.S. persons receiving income from U.S. sources, as it helps determine the correct withholding tax rates. By submitting the W-8BEN, individuals can avoid unnecessary taxation on certain types of income, such as dividends, interest, and royalties.

Steps to complete the Form W-8BEN

Completing the Form W-8BEN involves several key steps to ensure accuracy and compliance:

- Provide personal information: Fill in your name, country of citizenship, and permanent address. Ensure that the information matches your official documents.

- Claim tax treaty benefits: If applicable, indicate the specific article of the tax treaty that applies to your situation. This may reduce the withholding tax rate.

- Sign and date the form: Your signature certifies that the information provided is true and correct. Be sure to date the form appropriately.

How to obtain the Form W-8BEN

The Form W-8BEN can be obtained directly from the Internal Revenue Service (IRS) website. It is available as a downloadable PDF, which can be printed and filled out by hand or completed electronically. Ensure you are using the most current version of the form to avoid issues with submission.

Legal use of the Form W-8BEN

The legal use of the Form W-8BEN is crucial for compliance with U.S. tax laws. This form must be submitted to the withholding agent or financial institution that requests it. It is important to keep the form updated, especially if there are changes in your residency status or if you become eligible for different tax treaty benefits.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the Form W-8BEN, it should be provided to the withholding agent before any payments are made to ensure proper withholding tax rates are applied. It is advisable to submit the form as early as possible to avoid delays in receiving income.

Form Submission Methods (Online / Mail / In-Person)

The Form W-8BEN can typically be submitted in several ways, depending on the requirements of the withholding agent:

- Online: Some financial institutions allow electronic submission of the form through their secure portals.

- Mail: The completed form can be mailed directly to the withholding agent. Ensure you send it via a reliable postal service.

- In-Person: If applicable, you may deliver the form in person to the financial institution or withholding agent's office.

Quick guide on how to complete w 8ben 2017 2019 form

Discover the simplest method to complete and endorse your Form W 8ben

Are you still spending time creating your official paperwork on paper instead of doing it digitally? airSlate SignNow offers a superior approach to complete and endorse your Form W 8ben and related forms for government services. Our advanced electronic signature platform equips you with all the tools necessary to handle documents swiftly while adhering to official standards - powerful PDF editing, management, protection, signing, and sharing capabilities readily available within an intuitive interface.

Only a few steps are required to complete to fill out and endorse your Form W 8ben:

- Upload the editable template to the editor using the Get Form button.

- Verify what details you need to enter in your Form W 8ben.

- Move between the fields using the Next button to avoid missing any information.

- Utilize Text, Check, and Cross tools to populate the fields with your information.

- Modify the content with Text boxes or Images from the top menu.

- Emphasize what is crucial or Obscure sections that are no longer relevant.

- Click on Sign to create a legally enforceable electronic signature using your preferred method.

- Add the Date next to your signature and conclude your work with the Done button.

Store your completed Form W 8ben in the Documents folder of your profile, download it, or transfer it to your desired cloud storage. Our platform also supports versatile form sharing. There's no need to print your forms when you need to send them to the relevant government office - do it via email, fax, or by requesting a USPS “snail mail” delivery directly from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct w 8ben 2017 2019 form

FAQs

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

As a Canadian working in the US on a TN-1 visa should I fill out the IRS Form W-8BEN or W9?

Use the W-9. The W-8BEN is used for cases where you are not working in the U.S., but receiving income relating to a U.S. Corporation, Trust or Partnership.

-

Why do I have to fill out a W-8BEN form, sent by TD Bank, if I am an F1-student (from Canada) that is not working?

Of course you are not working. But the bank needs to notify the IRS of the account and it using the W-8BEN for to get the info it needs about you.

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

Create this form in 5 minutes!

How to create an eSignature for the w 8ben 2017 2019 form

How to generate an electronic signature for your W 8ben 2017 2019 Form in the online mode

How to generate an electronic signature for your W 8ben 2017 2019 Form in Chrome

How to generate an electronic signature for putting it on the W 8ben 2017 2019 Form in Gmail

How to generate an electronic signature for the W 8ben 2017 2019 Form straight from your mobile device

How to make an eSignature for the W 8ben 2017 2019 Form on iOS devices

How to generate an eSignature for the W 8ben 2017 2019 Form on Android devices

People also ask

-

What is a W-8BEN form and who needs it?

The W-8BEN form is a tax document required by the IRS for foreign individuals and entities receiving income from U.S. sources. It certifies the foreign status of the individual and helps claim tax treaty benefits. If you're a non-U.S. resident receiving payments, you'll likely need to complete a W-8BEN form.

-

How can airSlate SignNow help me with the W-8BEN form?

airSlate SignNow simplifies the process of completing and eSigning the W-8BEN form. With our easy-to-use platform, you can fill out the form digitally, ensuring accuracy and compliance. Plus, our secure storage allows you to keep your documents organized and accessible.

-

Is there a cost associated with using airSlate SignNow for the W-8BEN form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions allow you to eSign and send documents like the W-8BEN form efficiently. Explore our pricing options to find the perfect fit for your requirements.

-

Can I integrate airSlate SignNow with other software to manage my W-8BEN forms?

Absolutely! airSlate SignNow provides seamless integrations with popular tools like Google Drive, Salesforce, and more. This allows you to manage your W-8BEN forms along with other documents in one streamlined workflow.

-

Are my W-8BEN forms secure with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform incorporates advanced encryption and compliance measures to ensure that your W-8BEN form and other sensitive documents are protected from unauthorized access. You can trust us to keep your information safe.

-

How long does it take to complete and send a W-8BEN form with airSlate SignNow?

Using airSlate SignNow, you can complete and send the W-8BEN form within minutes. Our intuitive interface allows for quick filling, eSigning, and sending of documents, helping you stay efficient and on schedule.

-

Can I track the status of my W-8BEN form submissions?

Yes, airSlate SignNow offers tracking features that let you monitor the status of your W-8BEN form submissions. You will be notified when recipients view, sign, or complete the documents, providing full transparency throughout the process.

Get more for Form W 8ben

Find out other Form W 8ben

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free